Transforming

banking globally

Reshaping the future of financial services

PureSoftware, a wholly owned subsidiary of Happiest Minds Technologies, is one of the fastest growing software products and services companies that delivers a differentiated customer experience, accelerates cycle times and helps customers achieve business outcomes through the adoption of new-age digital technologies and integrating them with their existing systems.

We deliver digital excellence driven by next-gen solutions and strong partnerships globally

We help Businesses Transform with Simplified Next-Gen Technology Solutions that Address Complex Business Problems. Our domain expertise, strategic thinking, and a certified talent pool combined with a Customer-Centric Approach and Flexible Processes help us deliver on our promise of excellence. We create engagement models that drive cost and time reduction in projects while maintaining the highest software engineering standards.

Leverage our Smart Technology Solutions to add superior quality, enriched user experience to your products.

Discover how we can optimize your investments with technology consulting services tailored to make your business transform digitally.

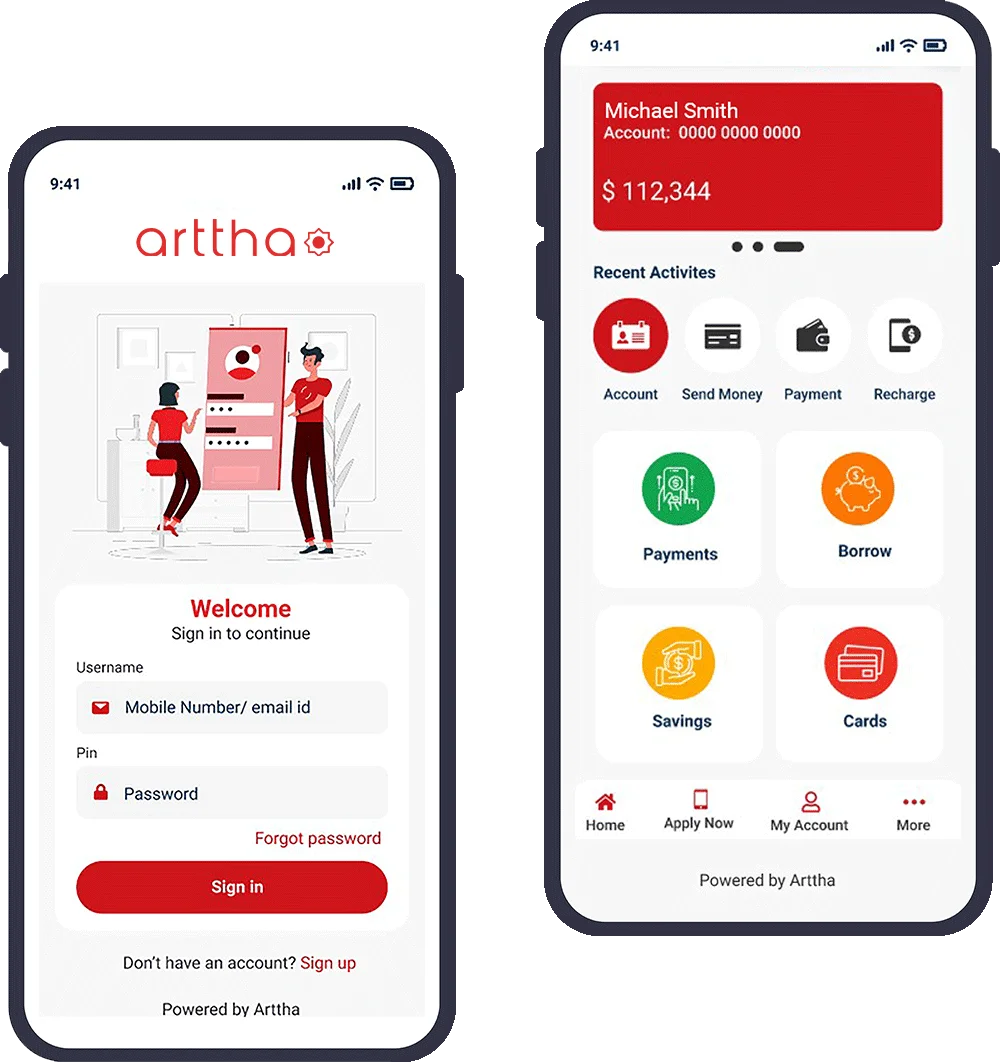

Dynamic capabilities, limitless banking possibilities

‘Arttha’ is PureSoftware’s award winning unified banking platform that enables financial institutions to accomplish their journey of digital transformation to promote financial inclusion. It uniquely offers propositions of Virtual Banking, Mobile Wallets, Digital Customer On-boarding, Agent Banking and Micro-Lending through a single converged platform based on a completely modular and microservices architecture.

The New Normal – Financial Services 2023 & Beyond.

Digital transformation is no longer a catchphrase, it’s now an absolute necessity for business success. The digital age is quickly pushing past the old world and the ‘Leaders’ that are quick to adapt to a mobile-first approach for their services will be the first to see improvement in their ROIs and earn some trust from their consumers.

Arttha: Built for the Future – Modular. Cloud-Native. Digital-First. An Exclusive Interview with IBS Intelligence

know morePureSoftware, a Happiest Minds Company, Secures Two Honors at IBSi Digital Banking Awards 2025 for Arttha’s Excellence in Digital Lending and Wallet Innovation

know moreHappiest Minds’ PureSoftware Launches FuzionX Gaming Studio™ to Redefine B2B Casino Gaming Services and Solutions

know more